A BAD FAITH INSURANCE LAWYER CAN HELP WHEN TRAGEDY STRIKES

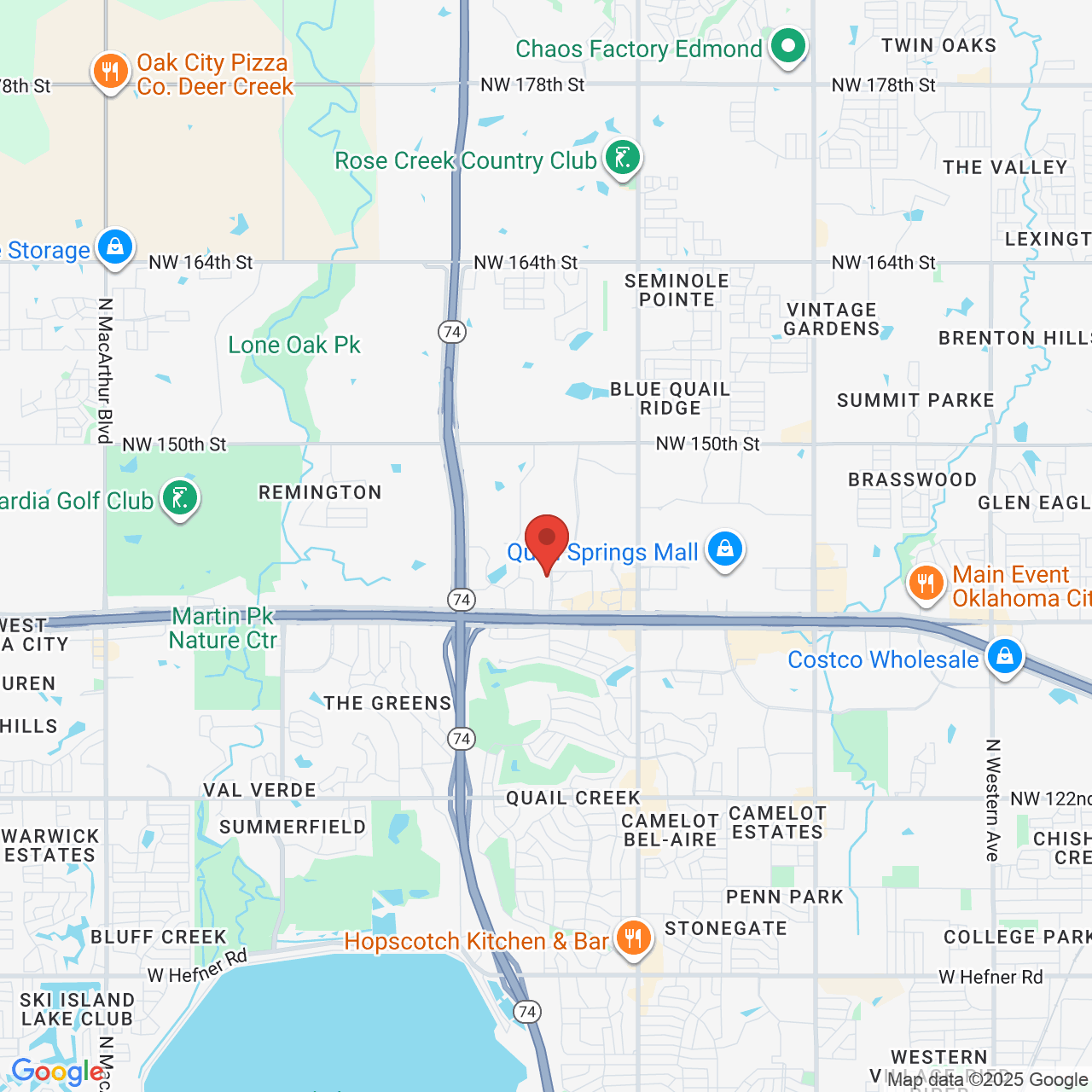

Insurance is meant to help cover property damage, medical bills, and other costs in the event of an accident or other unforeseen incident. When an insurance company does not honor its obligations, the insured may be entitled to filing a bad faith claim. The lawyers at the Tawwater Law Firm have extensive experience handling disputes between an individual policyholder and an insurance company over payment of a claim. If you are looking for a bad faith insurance lawyer in Oklahoma City, OK, or throughout the state, please reach out to us today. During your free consultation, we can determine if your circumstances warrant pursuing further legal action.

What is Bad Faith?

Insurance policies are legally binding contracts. The policyholder pays insurance premiums and the insurer agrees to defend and pay the insured if an event occurs that is covered under the policy. When an insurer fails to honor the terms of the policy (the contract), this is referred to as bad faith. Legally speaking, bad faith is an intentional dishonest act that involves the failure to fulfill legal or contractual obligations, entering into an agreement without the intention or means to fulfill it, misleading another party, or violating basic standards of honesty.

Examples of Bad Faith Insurance Practices

While insurance companies are meant help their policyholders, they are also interested in protecting their bottom line. As with any business, insurance companies exist to make money. They may rely on a host of tactics to avoid paying out a claim that detracts from their profits. This is not only frustrating, but when it violates a contract, this practice is illegal. Examples of bad faith insurance practices include when an insurance carrier:

- Cancels the policy or refuses to pay for coverage after a flood, fire, earthquake, or other disaster

- Cancels the policy or refuses to pay when the policyholder is in need of medical treatment

- Cancels the policy or refuses to pay when the policyholder is in a car, motorcycle, or other type of vehicular accident

- Will not defend you against a claim

- Fails to investigate a claim in a timely and thorough manner

- Delays payment of a claim for an unreasonable amount of time

- Withholds important information about your benefits

- Misrepresents the policy coverage when the policy is sold

- Fails to offer the fair value of a claim

- Does not disclose the policy benefits to the insured

- Unreasonably interprets the insurance policy

- Misrepresents facts or policy provisions to claimants

- Advises the claimant not to hire an attorney

- Misrepresents legal deadlines for filing a claim or initiating a lawsuit

- Refuses to settle a case

Illegally Canceling Your Insurance

A tactic insurance companies may pursue in order to avoid paying out is canceling your policy. This practice is known as insurance rescission. There are some ways in which a contract may be legally rescinded, including:

- Misrepresenting or concealing information on the insurance application

- Making a fraudulent or false insurance claim

- Breach of warranty

Too often though, an insurance company will illegally rescind a policy after the insured makes a legitimate claim. One tactic they may rely on is called post claim underwriting. Underwriting is the insurance company’s process of assessing your risk, and determining the likelihood of you making a claim. Post claim underwriting occurs when underwriting occurs after a claim is made. As an example, on a health insurance application, the insured indicates they had not previously suffered chest pain. A few years later, the insured has a heart attack and needs to undergo open-heart surgery. After the surgery, the insurance company commits post claim underwriting by determining that five years before the application the insured mentioned to their doctor they had experienced shortness of breath. The insurance company then denies the claim and rescinds the policy. The insurance company may then contact the victim, indicating they are not properly insured, and return the premiums.

The Need for Legal Representation

Most insurance companies have decades of experience in misrepresenting or misinterpreting policy language as the basis to deny a claim. In addition, they are backed by a powerful in-house team of legal insurance experts. With the chips stacked in an insurance company’s favor, the insured need aggressive and experienced legal representation to improve their chances of winning a bad faith claim.

A practiced bad faith insurance attorney can not only help you win your case, but also maximize how much you are awarded. Bad faith insurance is a type of tort law. This means that victims may sue for damages in addition to being reimbursed for expenses relating to the denied claim, such as lost wages and medical treatment.

The Timeframe for Filing a Suit

The bottom line is that the sooner you seek the assistance of an experienced insurance bad faith lawyer, the more advantageous it is for your case. Your lawyer can get started gathering evidence, taking witness statements, and lifting the burden of the case off your shoulders. There also are statutes of limitations, or deadlines for filing a lawsuit. This timeframe will depend on the circumstances of your case, but is typically one or two years. If you do not file your case within the statue of limitations, you forfeit the right to ever file a case.

The Tawwater Difference

For forty years, the attorneys at Tawwater Law have reached fair settlements and verdicts for our insurance bad faith clients. We have experience in all types of bad faith insurance cases, including:

- Uninsured motorists claims

- Business insurance

- Homeowners insurance

- Tornado damage

- Healthcare

- Long-term care

We have won tens of millions of dollars for clients relating to various bad faith cases, including overcharging premiums. We will press hard for settlement, or take giant corporations, like State Farm®, Allstate®, and Anthem® Blue Cross, to court to help you reach the compensation you deserve.

Schedule Your Free Legal Consultation Today

If your insurance company has illegally cancelled your policy, or refused to pay on a business, fire, flood, motorist, healthcare, or other type of claim, the attorneys at Tawwater are here for you. Contact our practice today to schedule your free consultation to determine your next legal steps.